Samples › Financial Accountant

Financial Accountant Sample

Download and customize our resume template to land more interviews. Review our writing tips to learn everything you need to know for putting together the perfect resume.

Financial Accountants play a vital role in many companies’ operations, helping drive growth and maintain financial transparency. If you’ve chosen this career path, then you already understand how important this work is.

Unlike many accountants who are focused on day-to-day financial activities, the Financial Accountant’s responsibilities involve not only preparing and managing the company’s financial documents but also analyzing data to ensure that the company’s executives have the insight they need to make great decisions for their stakeholders.

It’s a highly competitive field, though, and you’ll need an outstanding resume if you want to differentiate yourself from rival candidates. That’s why we’ve created this Financial Accountant resume guide that contains all the critical tips and tricks you need to know to craft your own resume. It also includes key insights and Financial Accountant resume examples that you can use as a reference during your resume creation efforts.

How to write a resume

Many job seekers fill out their resumes as though they’re filling out a simple job application. As a result, they end up with a finished product that’s anything but captivating.

The problem with that approach is that today’s companies are often forced to wade through dozens or even hundreds of resumes just to fill one open position. If your resume doesn’t deliver a powerful message about your potential value, chances are that you’ll struggle to separate yourself from the crowd.

In this guide, we’ll walk you through the steps you need to follow to craft a compelling resume narrative that captures employers’ attention. We’ll explain how to choose the right resume format and structure, which sections to include in your document, and how to demonstrate your value to prove that you have the skills you claim.

Related post: How to Make Your Resume Stand Out in 2024

Picking a format

Make sure that you choose the right format for your Financial Accountant resume. There are three main options that you can use:

Functional. This format is typically used by people who have little experience or major gaps in their work history. To mask that inexperience, a functional resume places the work experience section at the end of the document, after the skills and education sections. We recommend that job seekers avoid this option whenever possible since many employers view it with skepticism.

Reverse-chronological. If you have at least a few years of experience that relates to the job you’re seeking, then this is the format for you. The reverse-chronological resume is a great way to provide a detailed overview of your career trajectory since it lists your job roles in reverse order. To use it, simply start your work experience section by listing your most recent or current job. Then, list the next ten years of job roles in reverse order.

Combination. The combination format was designed to employ the best features of the other two options. It still allows you to focus on relevant skills but also lists your work experience in reverse chronology. If you’re trying to change careers, then this resume format could be just what you need to convey your transferable skills and major achievements to potential employers.

In most cases, we recommend that job seekers use the reverse-chronological resume format. It’s sure to be instantly recognized by hiring managers, who typically prefer that candidates present their resume information in a clear and transparent manner.

The importance of structure

Structure is also a vital component of any successful resume document. The structure that you choose needs to be simple and straightforward so that hiring managers can easily skim through your resume to find the information they’re looking for. To make that information more accessible, you need to group distinct types of information into specific sections. We’ll examine each of the most important sections below.

Contact information

Always place your contact details at the top of your resume to ensure that employers can quickly find your information when they need to schedule an interview or present you with a job offer. While this section might seem like window-dressing, it’s a vital component of any successful resume. Here are the details you should include:

Your first and last name. Make sure that you use a slightly larger text and bold it for emphasis.

Your location. This should just be your city and state – don’t include your street address.

Your phone number. Use a working cell or home phone number that enables employers to reach you.

Your email address. Use a professional email address that you regularly check. If you don’t have one, create a new Gmail address.

Your LinkedIn URL if you have one.

Resume headline

Some resume experts will suggest that you add your job title to the contact section of your resume, but we usually recommend a different approach. Simply take that job title and add some descriptive text to create a resume headline that grabs an employer’s attention. In other words, don’t just write the job title, Financial Accountant. Instead, add some flourish that sets you apart from rival job seekers. For example:

Data-driven and Insightful Financial Accountant and Growth Advisor

That headline should help differentiate you from every other candidate for the position. It focuses on key skills and specialties, using dynamic language that will help inspire your reader to dig deeper into your resume.

Related post: 30+ Resume Headline Examples (2024 Update)

Resume summary

The resume summary section goes right below your headline and provides your first real introduction to the employer. As the name suggests, this section should be a summarization of your experience, key skills, and measurable achievements. If you prefer, you can think of it as a basic elevator pitch – a brief paragraph of no more than four or five sentences – that highlights your qualifications and potential value as an employee. Here’s an example of a financial accountant resume summary:

Detail-oriented Financial Accounting professional with 8+ years of experience in management of general accounting functions, AP/AR, P&L analysis, and finance project management. Critical thinker committed to identifying improvement opportunities through data-based creative forecasting. Excellent communication and collaborative skills. Led financial department reorganization project at ABC Corp. that reduced inefficiencies and costs by more than 30% annually.

Core competencies

This section is the first one to warrant a heading. You can label it Core Competencies, Relevant Skills, or just Skills. Don’t get too creative with the name. Within this section, you should list all the most relevant skills that highlight your qualifications for the job. List these skills using bullet points, and then format that entire list into two or three columns. Try to limit the total number of skills to no more than twelve or fifteen abilities.

Also, make sure that you include all the skills listed in the job posting. If the employer cited them as qualifications, then there’s a good chance that those words are keywords that will be used to screen your resume. Many companies use applicant tracking systems to perform these screenings, and your failure to include those exact keywords in your resume could cause it to be rejected by the machines.

Related post: ATS Resume Test: Free ATS Checker & Formatting Examples (2024)

Work experience

Your work experience section deserves special attention since it’s the best place to demonstrate the type of value that you can provide for any new employer. Begin by listing each job you’ve held for the last ten years in reverse-chronological order.

For each role, include the company name and location, dates of employment, and your job title. Once that’s done, you should include four to six bullet-point achievements that demonstrate your results. More on that in a moment.

Education

Your education section should include educational credentials that satisfy the job posting’s requirements. Always include the degree that you earned, the college you attended, and your date of graduation. If your course of study can add anything to your qualifications, include those details too. As a rule, there’s no need to include your GPA – unless the employer requested that information in the job posting.

In addition to those six sections, you can also add optional sections focused on certifications, awards, or other relevant details that can bolster your candidacy.

Demonstrating value through achievements

As promised, it’s time to talk about those achievements for your work experience section. Each of these bullet point examples of your work results should focus on the value you provided. Use real numbers that highlight the money you saved or earned for the company and other measurable results that provide concrete value.

For example:

Performed regular forensic accounting that identified more than $20 million in savings over a three-year period

Delivered insightful forecasts used by company executives to initiate four $30+million mergers and acquisitions

Developed and implemented process improvements that reduced departmental inefficiencies by 21%

Financial Accountant resume example

Before we look at some examples of the types of skills you’ll need to include in your Financial Accountant resume, it’s time to provide that resume example we promised at the beginning of the guide. You can use this example as a template for your own resume by simply replacing its details with yours. Alternatively, you can just use it for inspiration.

Name

Title

City, State or Country if international

Phone | Email

LinkedIn URL

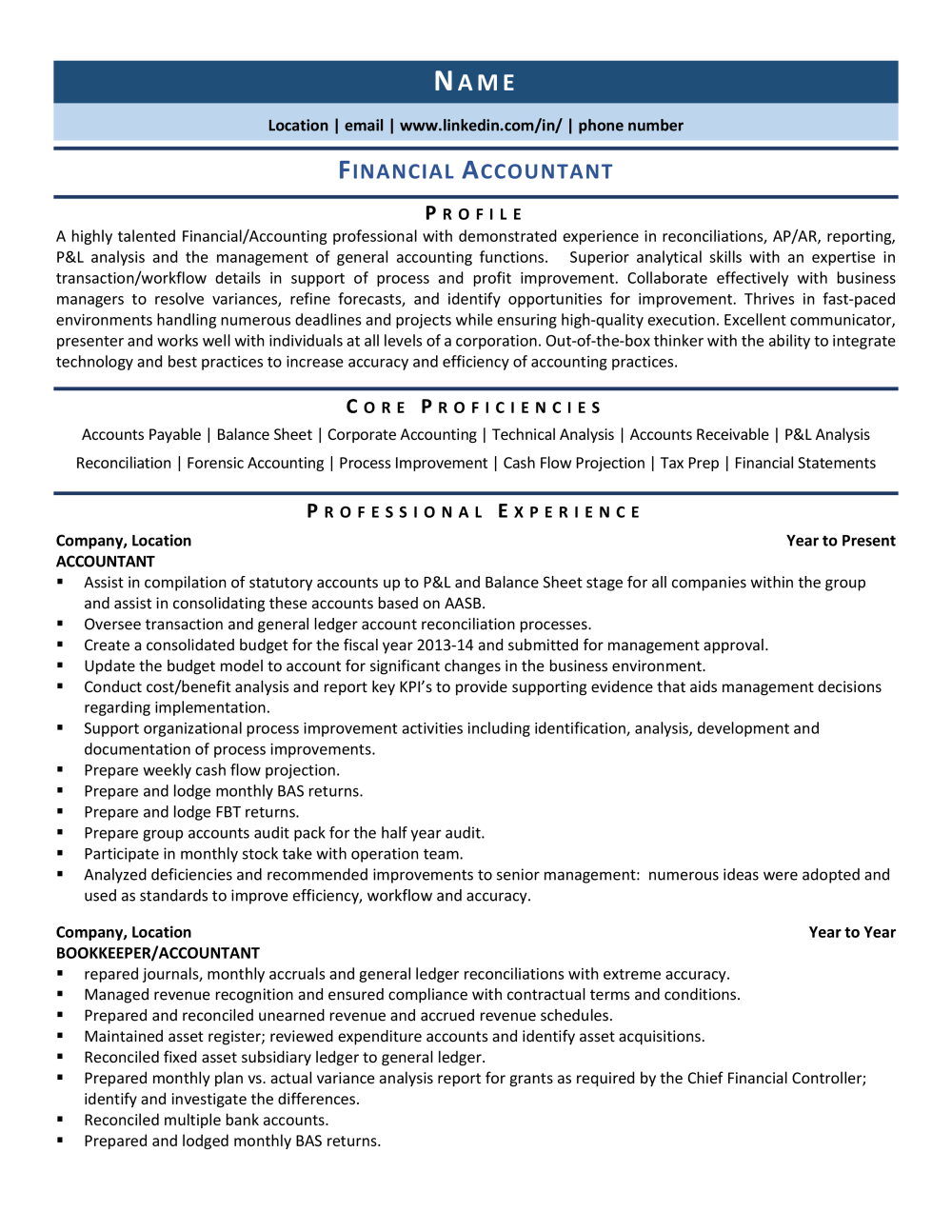

FINANCIAL ACCOUNTANT PROFESSIONAL

A highly talented Financial/Accounting professional with demonstrated experience in reconciliations, AP/AR, reporting, P&L analysis and the management of general accounting functions. Superior analytical skills with an expertise in transaction/workflow details in support of process and profit improvement. Collaborate effectively with business managers to resolve variances, refine forecasts, and identify opportunities for improvement. Thrives in fast-paced environments handling numerous deadlines and projects while ensuring high-quality execution. Excellent communicator, presenter and works well with individuals at all levels of a corporation. Out-of-the-box thinker with the ability to integrate technology and best practices to increase accuracy and efficiency of accounting practices.

CORE COMPETENCIES

Accounts Payable

Balance Sheet

Corporate Accounting

Technical Analysis

Accounts Receivable

P&L Analysis

Reconciliation

Forensic Accounting

Process Improvement

Cash Flow Projection

Tax Prep

Financial Statements

PROFESSIONAL EXPERIENCE

Accountant

Company | Location | Year to Present

Responsibilities

Assist in compilation of statutory accounts up to P&L and Balance Sheet stage for all companies within the group and assist in consolidating these accounts based on AASB.

Oversee transaction and general ledger account reconciliation processes.

Create a consolidated budget for the fiscal year 2013-14 and submitted for management approval.

Update the budget model to account for significant changes in the business environment.

Conduct cost/benefit analysis and report key KPI’s to provide supporting evidence that aids management decisions regarding implementation.

Support organizational process improvement activities including identification, analysis, development and documentation of process improvements.

Prepare weekly cash flow projection.

Prepare and lodge monthly BAS returns.

Prepare and lodge FBT returns.

Prepare group accounts audit pack for the half year audit.

Participate in monthly stock take with operation team.

Analyzed deficiencies and recommended improvements to senior management: numerous ideas were adopted and used as standards to improve efficiency, workflow and accuracy.

Bookkeeper/Accountant

Company | Location | Year to Year

Responsibilities

Prepared journals, monthly accruals and general ledger reconciliations with extreme accuracy.

Managed revenue recognition and ensured compliance with contractual terms and conditions.

Prepared and reconciled unearned revenue and accrued revenue schedules.

Maintained asset register; reviewed expenditure accounts and identify asset acquisitions.

Reconciled fixed asset subsidiary ledger to general ledger.

Prepared monthly plan vs. actual variance analysis report for grants as required by the Chief Financial Controller; identify and investigate the differences.

Reconciled multiple bank accounts.

Prepared and lodged monthly BAS returns.

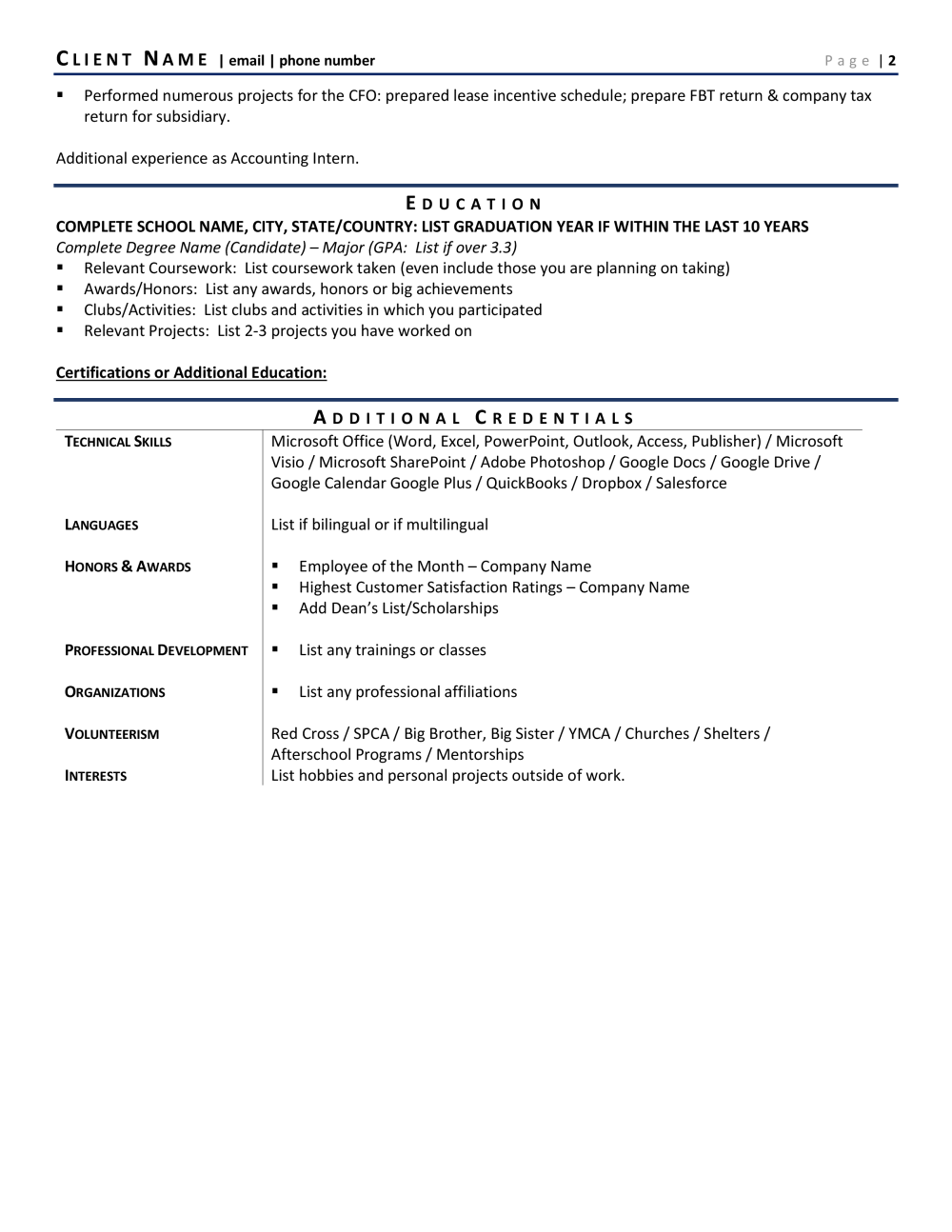

Performed numerous projects for the CFO: prepared lease incentive schedule; prepare FBT return & company tax return for subsidiary.

EDUCATION

Complete School Name, City, St/Country: List Graduation Years If Within the Last Ten Years

Complete Degree Name (Candidate) – Major (GPA: List if over 3.3)

Relevant Coursework: List coursework taken (even include those you are planning on taking)

Awards/Honors: List any awards, honors or big achievements

Clubs/Activities: List clubs and activities in which you participated

Relevant Projects: List 2-3 projects you have worked on

Key hard & soft skills for a Financial Accountant

You’ll want to include a mix of both hard technical skills and soft interpersonal abilities in your Core Competencies section. Remember, hard skills are usually developed through formal education, training, and hands-on learning. Soft skills include personality traits, thought processes, and key people skills that you use to interact with others. Below are some common skills that you should consider including in your Financial Accountant resume.

Possible Financial Accountant resume hard skills

Accounting software

Generally Accepted Accounting Principles (GAAP)

Financial statement preparation

Data analysis

Regulatory compliance expertise

Industry-specific knowledge

Corporate accounting

Reconciliation

Auditing

Possible Financial Accountant resume soft skills

Time management

Project management

Critical thinking

Commitment to integrity

Written and verbal communication

Active learning

Attention to detail

Collaboration

Creative thinking

Summary & last words

Hiring managers typically spend no more than a few seconds skimming your resume. Unless you’ve focused on delivering a truly compelling message that captures their attention in that limited time, chances are that your resume will get lost in the crowd. When you create a resume that highlights your skills, experience, and measurable achievements in a way that broadcasts your value to each employer, you can turn those odds in your favor and start landing the interviews you need to secure great job offers.

Related post: Beginner's Guide to How to Write a Resume

Introduction to ZipJob: Professional resume writers

But what if you still don’t feel like you’re ready to create the convincing resume you need to further your career goals? Many professionals just like you choose to rely on resume writing services to ensure that they receive a truly personalized, professional resume that they can use with confidence. That’s where ZipJob comes in. Our team of experienced professionals has a proven track record of success and will collaborate with you to craft a powerful resume document that secures more interviews.

Why you should make use of our resume writing services to land your next job as a Financial Accountant

When it’s time to select a resume-writing service, there’s one clear choice: ZipJob. Our team of professional resume writers has the experience and expertise needed to help you craft a winning resume. Just as important, they have deep industry knowledge and insight that enables them to know what today’s employers want to see when they read your resume. And because they’re well-versed in the latest ATS technology, your resume will be optimized to get past those automated screens.

Resume writing service for a Financial Accountant: Let us write your resume

A professional resume is an investment in your future – and can be an invaluable tool for expediting your career success. By partnering with us, you can rest assured that your resume will deliver a powerful narrative that makes a positive first impression on prospective employers. Contact us to learn more about how we can help you get the Financial Accountant resume you need to land your next interview and advance your career.